The Medicare Charge That's Taking a Bigger Bite Out of Social Security Checks

Retirement | Medicare | IRMAA | Social Security | Health care | Medical insurance | February 11, 2026

This Week's Quote:

“The bad news is time flies. The good news is you're the pilot.”

―Michael Alexander

Elaine Young, a 66-year-old widow living near Philadelphia who does her own taxes, is confused and annoyed.

“I got a letter from Social Security congratulating me on my 2.8% cost-of-living inflation adjustment for 2026. But they’re taking a third of my payment for Medicare, and this year I’m getting less per month than last year. What’s the inflation adjustment for Medicare premiums?” she asks.

Good question, Ms. Young. Other seniors are likely asking it as they see the rising cost of Medicare Part B premiums (for doctors and outpatient care) and Part D premiums (for drugs) reduce their own Social Security payments. This is especially true for those who, like Young, are affluent and owe charges called “income-related monthly adjustment amounts,” or Irmaa.

What gives? The short answer is that Social Security payments are income that’s adjusted for inflation. Medicare premiums are determined by overall medical costs and are subtracted from your Social Security payments. But there is a further subtraction for Irmaa, if your income exceeds certain thresholds.

And Irmaa leads to a longer, more complex answer. It’s increasingly important because Medicare Irmaa charges for about six million, higher-earning Americans today are projected to rise significantly. According to the 2025 Medicare Trustees Report, overall Part B Irmaa charges alone are expected to increase 30% from 2026 to 2030.

Originally, Congress intended Medicare recipients to bear 25% of its costs through premiums that are adjusted annually, with the other 75% coming from government revenues.

As costs rose, lawmakers decided that higher earners should bear more of the program’s expenses. The result was Irmaa. Like basic premiums for Medicare, Irmaa charges are calculated annually based on the expected costs of the program—not the inflation increases used by Social Security.

For 2026, five income tiers of earners who pay for Part B or Part D are subject to Irmaa. Medicare recipients in these tiers are expected to pick up 35%, 50%, 65%, 80% or 85%, respectively, of their projected Medicare cost through premiums, rather than 25%.

For these seniors, the charges begin at $109,000 of modified adjusted gross income (MAGI) for single filers and top out at MAGI equal to or greater than $750,000 for married joint filers this year. (For Irmaa, MAGI is defined as adjusted gross income plus tax-exempt interest from municipal bonds.)

The Social Security Administration collects Irmaa based on each Medicare recipient’s income from two years earlier. So 2026 amounts are based on information from 2024 tax returns supplied by the IRS.

Social Security then deducts Irmaa from monthly benefit payments for recipients. Those who are on Medicare but not yet receiving Social Security payments are billed separately.

Here’s what the Irmaa increases could mean for one hypothetical couple who in 2026 are joint filers in the first income tier—that’s MAGI between $218,000 and $274,000. This year they’ll owe basic Part B premiums of $4,870, plus a variable amount for Part D premiums. But they will also owe combined Part B and D Irmaa of nearly $2,300 on top of the basic premium amounts.

In 2030, according to the Medicare Trustees Report, the Part B and D Irmaa for this couple could be $3,425, or about 50% higher, on top of increases in basic premiums.

“Healthcare costs are rising, and this is showing up in the form of higher basic premiums for Medicare and higher Irmaa charges as well,” says Juliette Cubanski, deputy director of Medicare policy for KFF, a healthcare research nonprofit.

To be sure, even with Irmaa charges Medicare premiums often remain a bargain when compared with the cost of other health coverage—if one can get it.

Ms. Cubanski says that according to KFF’s ACA premium calculator, the cost of a silver plan for a 64-year-old nonsmoking single person with no children who earns $150,000 and has no employer coverage or federal subsidy would be $1,466 a month.

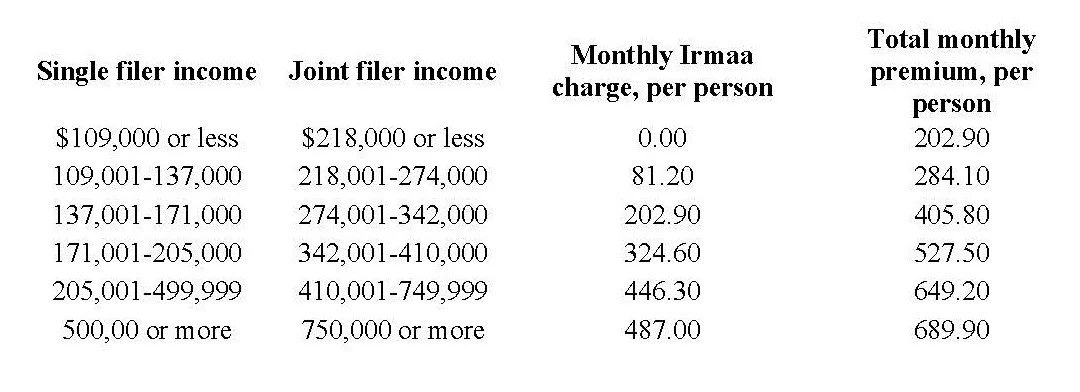

2026 Irmaa charges for Medicare, Part B

Note: Income is defined as adjusted gross income plus tax-exempt interest for 2024. Figures are different for immunosuppressive drug-only Part B coverage. Irmaa charges also apply for Medicare Part D drug coverage.

Source: Centers for Medicare and Medicaid Services

Meanwhile, a similar person who is 65 and eligible for Medicare would owe about $482 a month for Part B and D coverage, assuming the Part D coverage has an average premium. That includes about $240 a month of Irmaa charges, says Ms. Cubanski.

For seniors in the crosshairs of Irmaa, here are strategies to consider.

Watch your MAGI. It’s important to keep the Irmaa MAGI as low as possible, because—unlike with income taxes—even a dollar of extra income can bring a much higher charge. This year, a single filer with MAGI of $137,000 or less would likely owe Part B Irmaa of about $975. But if her income is $137,001, she’d owe about $2,435, says Richard Pon, a CPA in San Francisco.

Managing MAGI is often hard because Irmaa is based on income from two years prior. Some filers try to leave a “margin of safety” to avoid triggering a higher tier.

Others may try to push lots of income into one year and incur higher Irmaa only for that period. If income drops in following years, Irmaa can drop as well.

Have income that doesn’t raise MAGI. Under current law, Roth IRA withdrawals aren’t included in MAGI, nor are withdrawals from Health Savings Accounts (HSAs).

For charitable givers who are 70½ and older, making donations via qualified charitable distributions of traditional IRA assets won’t raise MAGI either. As noted many times in this column, QCDs are often the most tax-efficient way to give.

In addition, seniors owning businesses may be able to manage income and avoid raising MAGI in some years.

Plan capital gains. Got a big gain coming? See if spreading it over two years (or more) could help avoid Irmaa—and maybe higher income-tax rates as well.

Ask for an Irmaa refund. Yes, you can get a refund if your income that triggered Irmaa was abnormally high due to a “life event.” The form to request it is SSA-44. Acceptable reasons for a refund include marriage, divorce or spousal death; work stoppage or reduction; loss of income-producing property, such as from a disaster; loss of pension income; or an employer settlement payment.

In addition, says Pon, Medicare recipients may qualify for an Irmaa refund if they file an amended tax return. He recommends calling 800-772-1213 and asking for an Irmaa refund based on the return.

What’s not an acceptable reason for an Irmaa refund? Among others: a Roth IRA conversion; a large capital gain; and employer bonus or stock-option income.

Credit goes to Laura Saunders, Wall Street Journal, January 23, 2026.

Thank you for all of your questions, comments and suggestions for future topics. As always, they are much appreciated. We also welcome and appreciate anyone who wishes to write a Tax Tip of the Week for our consideration. We may be reached in our Dayton office at 937-436-3133 or in our Xenia office at 937-372-3504. Or, visit our website.

This Week’s Author, Mark Bradstreet