Ohio Income Tax Updates

A filing season approaches, we are often focused on thefederal changes to tax law, but one shouldn’t fail to keep their eyes and earsopen to the state changes. For those ofus in Ohio, the 2019 tax law changes were fairly mild. Below are a few of the key changes to Ohiotax law for the 2019 tax year.

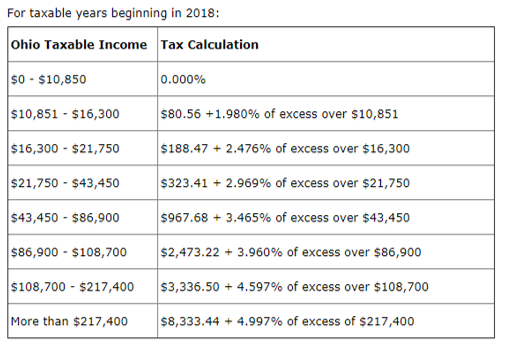

Change in Tax Brackets:

Following the example of the Federal government, Ohio hasdecreased the number of tax brackets and overall tax rates which are applicableto the 2019 tax year. The change inrates are displayed below:

Ohio Earned Income Credit:

The Ohio Earned Income Credit (EIC) was also expanded andsimplified for 2019. Historically, thecredit was calculated utilizing 10% of the Federal EIC, and possibly subject tolimitations based on income. For the2019 tax year, the credit is simply 30% of the Federal EIC.

Modified Adjusted Gross Income (MAGI):

The 2019 tax law introduces a new term for purposes of meanstesting. Means testing is applied todetermine exemption amounts and qualifications for certain credits. Historically, Ohio Adjusted Gross Income(OAGI) was used in means testing. Theprimary difference with this new metric is that income which would have beenexcluded under Ohio’s generous Business Income Deduction is now included formeans testing. Note, that this doesn’tmean that the business income is now taxable. It simply means that this income will be considered when determiningexemptions and credit qualifications.

In the ever-changing world of taxes, the changes take placenot only on the Federal level, but on the state, and even local as well. We strive to stay abreast of these changes,and help you make the best tax-conscious decisions.

Thank you for all of your questions, comments and suggestions for future topics. As always, they are much appreciated. We also welcome and appreciate anyone who wishes to write a Tax Tip of the Week for our consideration. We may be reached in our Dayton office at 937-436-3133 or in our Xenia office at 937-372-3504. Or, visit our website.

This week's author - Josh Campbell